How Can Time Value Of Money Be Used In Making Financial Decisions

Time value of money (TVM) is the near fundamental and of import concept in finance. This concept basically means that the money you have at hand is worth more than the coin that volition exist bachelor in the future / later on some time. In other words, a dollar is worth more today than if y'all were given information technology in the future. And this is so considering of the time gap, the uncertain hereafter, the touch of inflation, and so many other financial and economic factors. The TVM concept serves as the ground for many other fiscal concepts and also helps in conclusion-making. The age-old proverb "one bird in the hand is more than 2 in the bush" confirms this fact to the bespeak. This concept is amend understood, and the importance of the fourth dimension value of money in fiscal decision-making is therefore crucial for all of us.

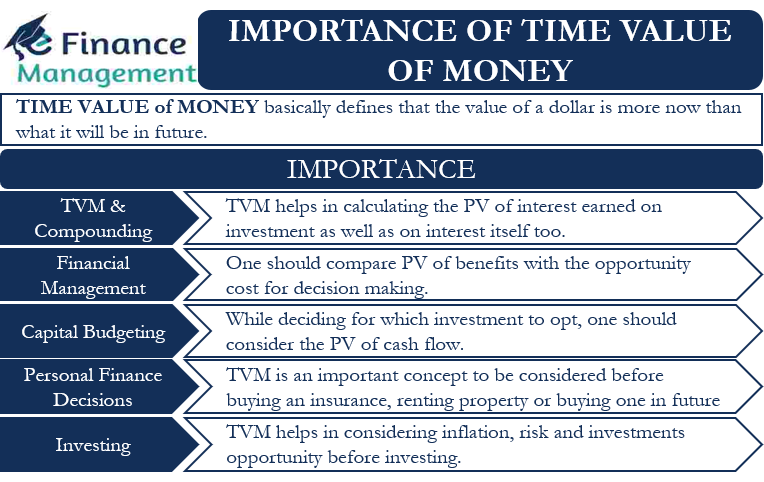

Importance of Fourth dimension Value of Money

The bones underlining idea of this concept is very unproblematic. Time Value of Money means that we should always prefer to go the funds/money now rather than getting it in the future, simply this is subject to the overriding caveat that other things are the same.

Table of Contents

- Importance of Time Value of Money

- Fourth dimension Value of Money and Compounding

- Fiscal Direction And Time Value of Coin

- Capital Budgeting And Time Value of Money

- Personal Finance Decisions And Fourth dimension Value of Money

- Investing and Fourth dimension Value of Money

- Terminal Words

- FAQs

The hereafter is uncertain, and even if someone promises to pay y'all fixed interest in the hereafter, it is still risky, so to decide which option to choose, nosotros need to constitute a relationship between the nowadays and future values of greenbacks flows. This would definitely help us make a better and more calculated decision. And, at this point, in deciding the preferred option, the TVM concept comes in handy. It helps u.s. clearly understand and bridge the gap between the present value (PV) and future value (FV) of the money under consideration.

TVM bridges the gap between the two with the help of a discount rate. PV, FV, and discount rate are the 3 components of TVM. Together, these 3 components help in almost all types of fiscal controlling.

Aye, TVM helps bridge the gap between PV and FV, but why bridging this gap is important? The following points will help explain this, and they will also explain the importance of the time value of money:

Fourth dimension Value of Money and Compounding

The compounding consequence is perhaps the most important application of the TVM concept. In compounding interest investment, apart from yearly interest on the principal, interest is likewise calculated on earlier years' interest. In other words, the investor earns interest on the principal and on all the involvement on previous years. Various authors and experts have already called compounding the ninth wonder of the world; interest on interest has a spiraling touch on on the funds. Then, in order to get the maximum do good, you take to stay invested for a long time and enjoy the benefits of compounding.

For instance, to sympathize and capeesh the compounding concept, suppose a bond pays a 5% return on $1,000 over five years, in which case the bondholder receives $50 per twelvemonth or $250 over five years.

Suppose you put the same amount into a eolith business relationship with the same interest rate at maturity. In this instance, your annual interest rate continues to increase with each year/menstruum. In the commencement year, we receive $fifty in involvement, but in the 2nd twelvemonth, the interest amount will increase to $52.fifty and and so on for all subsequent years. This is because you too earn interest on the unpaid interest of the previous twelvemonth. The unpaid interest portion is treated as main, which continues to earn interest until maturity. Afterwards 5 years, the concluding payout is $1,276.

The reason why you got more money in the second instance is the duration of your investment or the fair value of your money.

Financial Management And Fourth dimension Value of Money

Since the coin is worth more than now than the same money in the time to come, TVM is therefore important for financial management. You lot tin can ever use the funds to make an investment and receive interest. Yet, when investing, you must take into account the opportunity costs.

Opportunity costs exist wherever options are available. Opportunity costs are, therefore, the benefit or involvement that one forgoes when ane prefers one investment over some other. Or, to put it just, opportunity costs are the next all-time bachelor and preferred investment. Therefore, when deciding on an investment, one should consider its opportunity costs. Opportunity costs are a TVM concept and help in controlling.

Uppercase Budgeting And Time Value of Money

TVM is very useful in capital budgeting as information technology helps management get an idea of their cash flows. In capital letter budgeting, we disbelieve the future cash flows to their present value to determine whether the project is worthy of investment or not.

When a company plans to make investments, for case, in machinery, to have over some other company, etc., information technology wants to get an idea of whether that investment will pay off or not. Or companies need to know whether the cash flows from the investment are sufficient to recoup at least the initial outlay. The TVM helps a business organisation in deciding and analyzing this attribute with the use of a discount rate.

In the fiscal globe, this disbelieve rate is used to discount and determine the present value of expected future cash flows. This discount rate depends on several factors, such as the ongoing interest rate, risk level, expected return, and more than. Arriving at a disbelieve rate is a difficult task. Of course, it becomes easy to arrive at the present value of all hereafter cash flows once you are washed with the discount charge per unit. However, in one case you have it, you can easily determine the present value of hereafter cash flows.

Personal Finance Decisions And Time Value of Money

The importance of the fourth dimension value of money is non only for corporate decision-making only also on a personal level. Knowing the TVM concept will help you come across the financial impact of every financial determination you brand. It would help you program your financial goals and aid you meet financial challenges. It would also aid yous compare and evaluate two or more investment options.

For instance, someone asks y'all to lend him $5000 at present for $v,500 a year afterwards. At beginning glance, information technology seems like an attractive investment option, as you lot become an extra $500. However, y'all need to consider the TVM to become the existent motion picture. If the PV of the future corporeality is smaller than the current amount, and so this investment is non worth it. And if the PV of the future amount is more, and then y'all should opt for this investment.

You lot can as well use the TVM concept when ownership insurance. About all of usa blindly trust what our brokers say, that later northward years, we would get ten times as much if nosotros now invest y amount now. However, you can always use the TVM concept to evaluate an insurance proposal. And can very well understand what charge per unit of interest the insurance company volition be giving out on your investment during the term of the insurance. The offering of giving an X-time return looks quite attractive on its face. Nonetheless, once nosotros attempt to wait at the present value and charge per unit of return, the attraction is sometimes over.

Other real-life applications of TVM that you lot tin easily apply in your daily life include:

- If you plan to buy a property and and then rent it out, the TVM concept can help yous determine the rental amount you should charge.

- If you are planning to buy a property in the hereafter and want to know how much to save, then TVM tin can also aid.

Investing and Time Value of Coin

Because of inflation, prices will rise over time. And the value of the available money volition decrease over fourth dimension. Therefore, the coin yous have is worth more today than in the future. Therefore, information technology is very important that you invest the money instead of keeping it in yourself or in a normal bank account. And the TVM helps you brand the better investment determination based on the post-obit factors:

Inflation – It is the continuous rise of the price level. The money in your pocket has more purchasing power today than in five years later on that. Therefore, an advisable investment tin but maintain or increase the value of your money over fourth dimension.

Risk – the future is uncertain so y'all may lose some or all of your money in the future, but you can reduce your risk by investing it right now.

Investment Opportunity – At that place are many means and options in which you can invest your coin. However, you lot lose the opportunity if you wait to invest your money. Whatever delay will lose the value of your money.

Final Words

The time value of money is a straightforward concept with many applications in the real world. It helps to explain the power of fourth dimension financially and helps you lot achieve your financial goals and find suitable investment opportunities.

FAQs

1. How is the Fourth dimension Value of Money important to investors?

Time Value of Coin plays a crucial role in investment decisions. The investor evaluates the present value of future cash inflows and compares this with the current cash outflows to guess the additional return that can be expected from this investment over time in terms of the current period.

two. Why is the value of present dollar is more than futures?

The value of the dollar in the present is higher than it will be in the hereafter because of inflation. Due to inflation, the value of coin/purchasing power of the dollar decreases. Today, one dollar has more purchasing power than tomorrow.

- What is Fourth dimension Value of Coin (TVM)? [Source]

- What is the Time Value of Money (TVM) and How You Tin Apply information technology to Help Plot Out Your Financial Future [Source]

- Importance of Time Value of Money [Source]

- Why the Fourth dimension Value of Money (TVM) Matters to Investors [Source]

Source: https://efinancemanagement.com/investment-decisions/importance-of-time-value-of-money

Posted by: wileylicep1943.blogspot.com

0 Response to "How Can Time Value Of Money Be Used In Making Financial Decisions"

Post a Comment